Condo Insurance in and around Gunnison

Unlock great condo insurance in Gunnison

Cover your home, wisely

Condo Sweet Condo Starts With State Farm

Your condo is your retreat. When you want to take it easy, laugh and play and kick back, that's where you want to be with the ones you love.

Unlock great condo insurance in Gunnison

Cover your home, wisely

Protect Your Home Sweet Home

That’s why you need State Farm Condo Unitowners Insurance. Agent Pete Klingsmith can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Pete Klingsmith, with a hassle-free experience to get reliable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Pete Klingsmith can help you file your claim whenever bad things happen. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

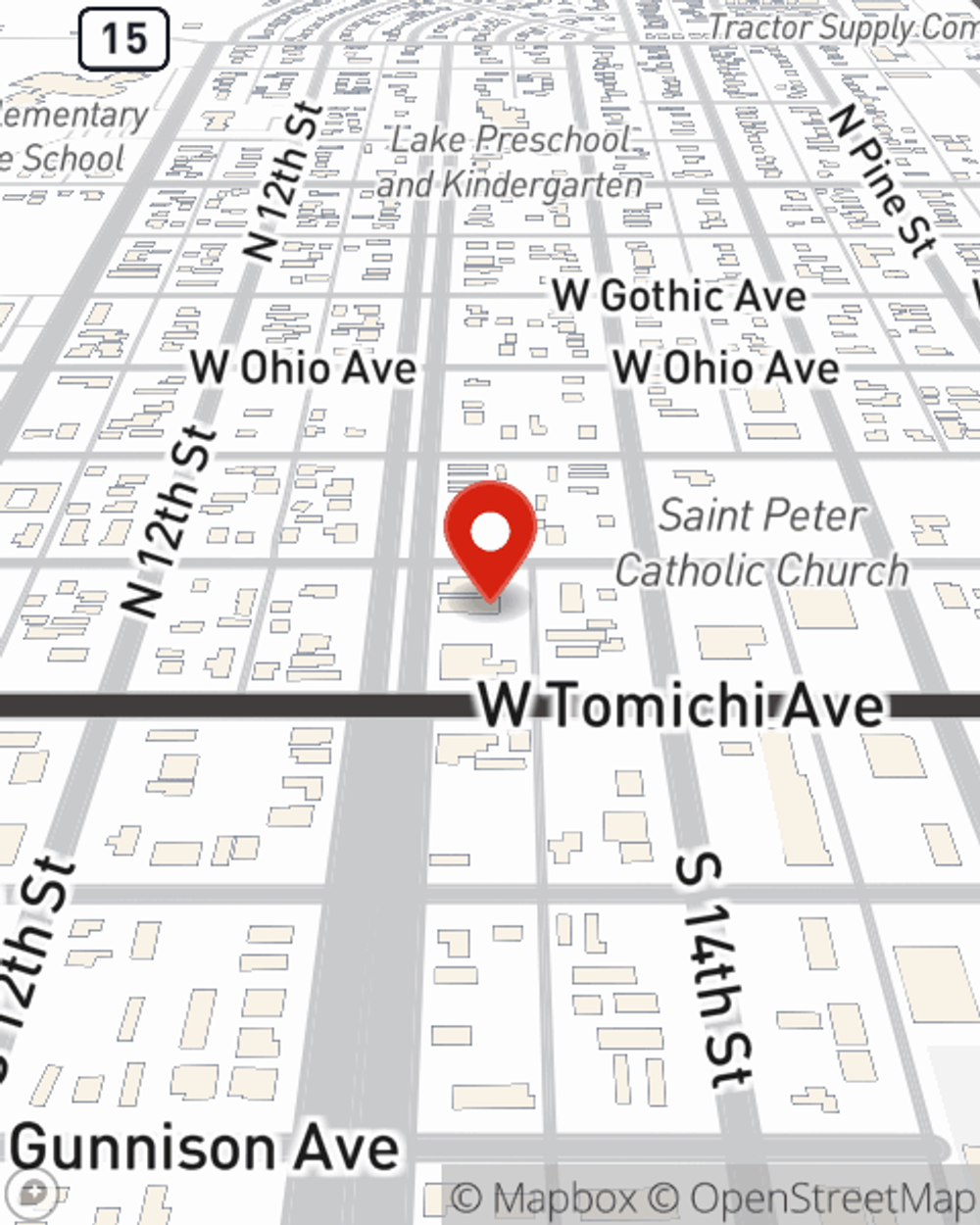

When your Gunnison, CO, condo is insured by State Farm, even if the unexpected happens, State Farm can help protect your property! Call or go online now and see how State Farm agent Pete Klingsmith can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Pete at (970) 642-3259 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Pete Klingsmith

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.